I require a lot of money!

When such a thought comes to your mind, then the situation is very tense and serious. Most of our life changing decisions involve a great deal of money. This amount will help us in getting successful in life. But the amount is very high and hence arranging for those funds is not possible every time. One of the best solutions in these times is taking a mortgage loan, more famously known as “loan against property”.

The mortgage loan process involves you keeping your residential or commercial property as collateral and getting around 40-65%* of the current market value as the loan amount. The bank will derive your current market value of the property. They will check your eligibility to get the best loan against property and accordingly provide you with a loan amount.

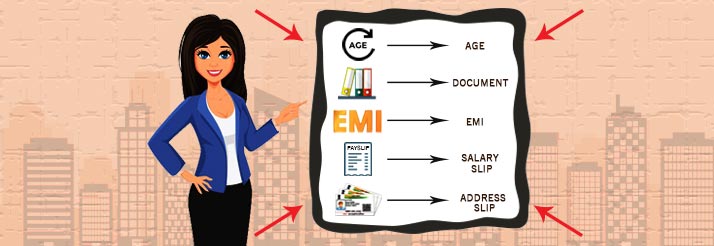

Just because you can get 40-65%* of the value as loan amount it does not mean that the bank will give you 65%. It all boils down to your eligibility. There are certain aspects you must consider before applying for a loan against property. These are;

The first aspect to notice is your age. In case you are young i.e. lesser than 35, this helps the bank in understanding your repayment ability. For those who are above 45 and have few years leading up to retirement, the banks do more checks to understand if the loan amount can be repaid without defaults or no.

The second aspect to notice is the documentation. You need to have all the documents related to the property which will be kept as collateral for the mortgage loan. All the originals, sale deeds, plans, NOC’s etc. The bank will do their checks to ensure everything is clear before approving the loan.

The third aspect to notice is the loan tenure. If you want a mortgage loan for a longer tenure, that means you will pay lower EMI’s and that reduces your chances for defaulting on loan repayment.

If you cannot show a stable income in the past 2-3 years, it shows the bank that you might be defaulting on any of the EMI’s. Hence maintain a stable income in order to prove your credit worthiness to the bank.

Apart from income, if you can show job stability in the past 3-5 years without multiple job shifting, the bank can develop trust in you as a customer. Shifting jobs repeatedly is a negative sign.

Filing your ITR is very important. The banks will ask for 3 years return filing and hence it is important to keep this. The banks derive the customer’s income credibility by checking the returns filed.

In case you have a decent credit history, it is very important to improve it. Banks place high emphasis on the credit score of the borrower. If you have a high credit score, you can be in a position to negotiate interest rates and also a waiver for processing charges and other fees.

In general, there can be more aspects revolving around getting a loan against property like legal and insurance issues. But the most basic ones are listed above. If you can take care of these aspects, then getting your mortgage loan application approved will be a hassle free process.

To enjoy a hassle free experience in loan against property