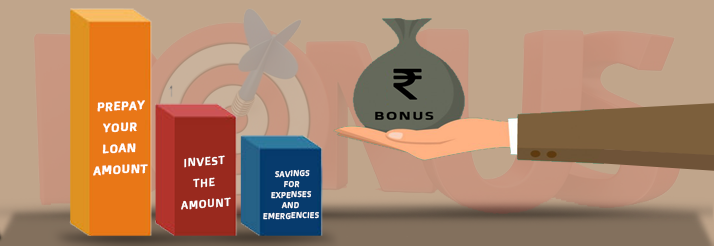

For a salaried employee, the word “Bonus” means a lot of things. While some dream of going for that long awaited vacation, some plan to splurge on a luxury. Some want to purchase new furniture/gadgets for their house and some just want to purchase a new vehicle. Many of us do get the luxury of a bonus every year and hence we have found 3 impressive ways that you can utilize this bonus amount in order to improve your financial stability. These are;

Prepay your loan amount:

You can start the process of being debt free by prepaying your loan fully or partly. Yes, by doing so, you reduce the interest burden and also this gives you a breather. You can also avail tax benefits on the interest amount.

There might be prepayment charges (around 2%* of the loan amount) set by your lender. Hence understand the charges and analyze if it’s worth the prepayment. If it is, then you can do the prepayment.

Invest the amount:

Investments are a good way of increasing your wealth over a period of 3-5 years and more. You can opt for investments in mutual funds or stock market. Your investment plan must be in such a way that it helps you reduce the loan burden from you and simultaneously help you increase your wealth.

Savings for expenses and emergencies:

One more possibility that an individual needs to remember is an emergency or an unplanned expense. If you prepay or invest the amount and an emergency strikes, then arranging cash would be a difficult task. Hence you can consider to keep the amount in your savings account where it would yield anything between 4-6%* or deposit in Fixed or recurring deposits which give you more than 6%*.

Hence an annual bonus can be very helpful if you plan and execute its uses.